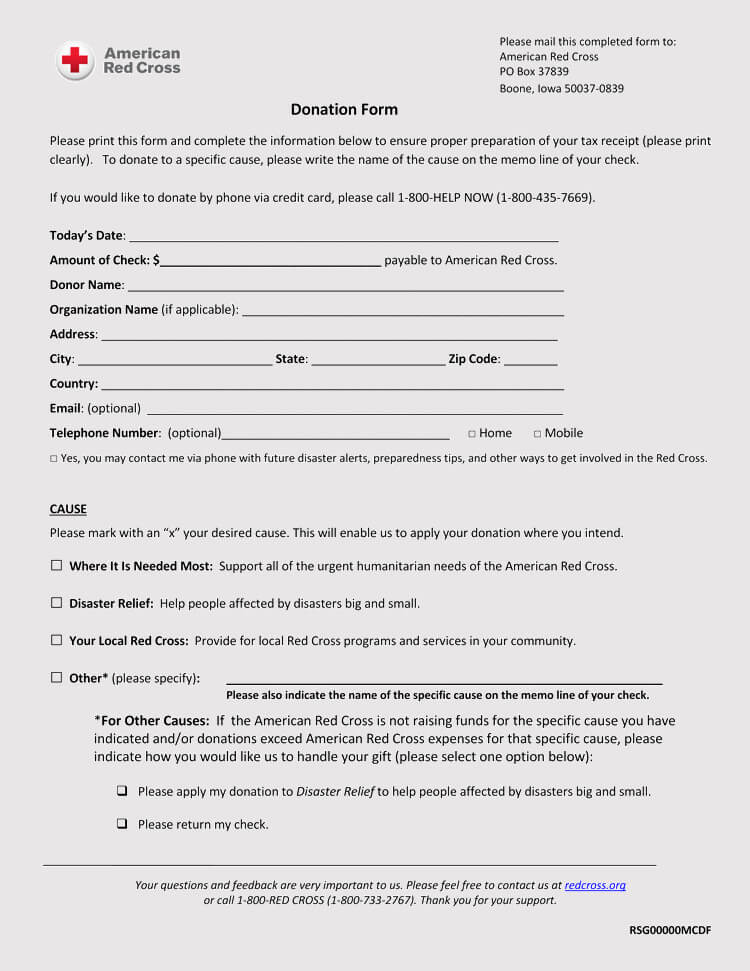

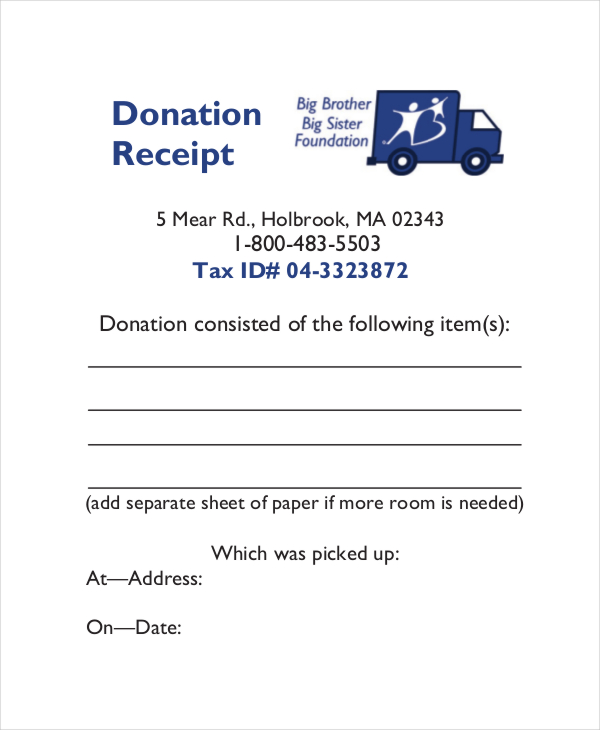

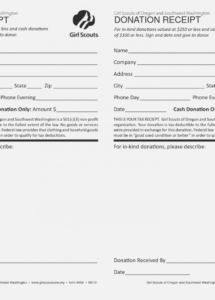

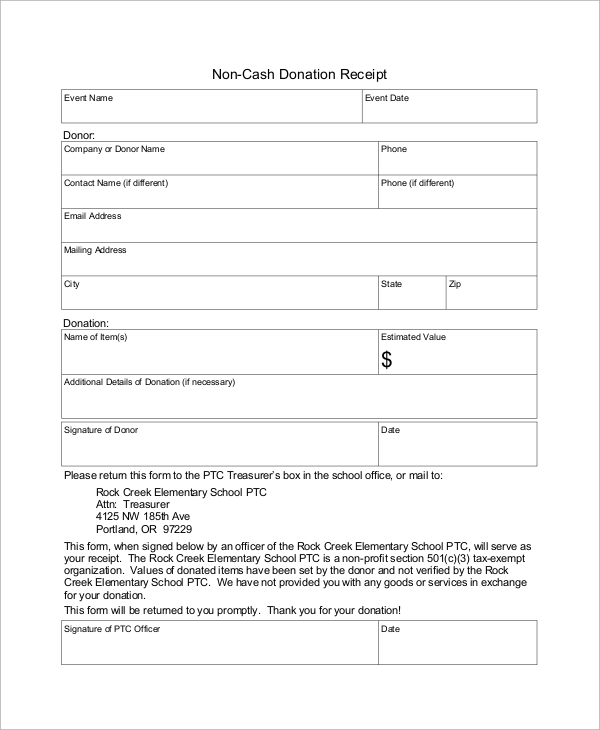

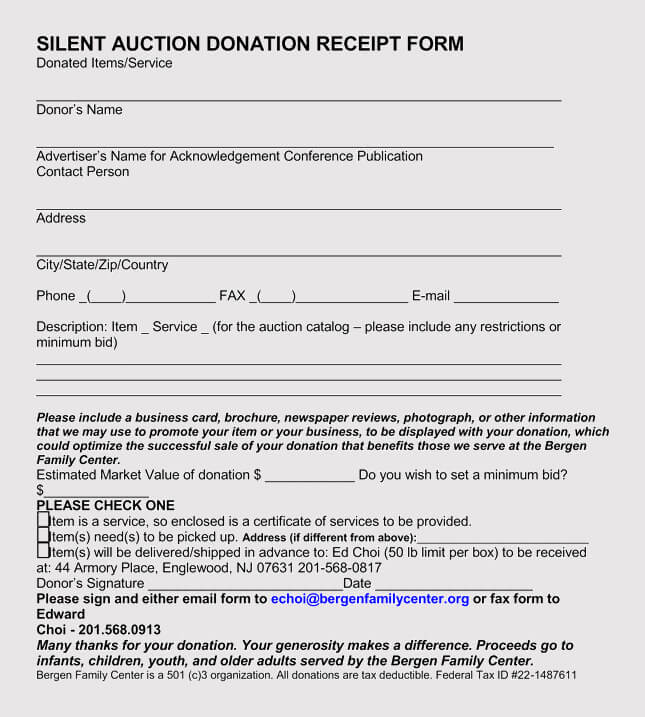

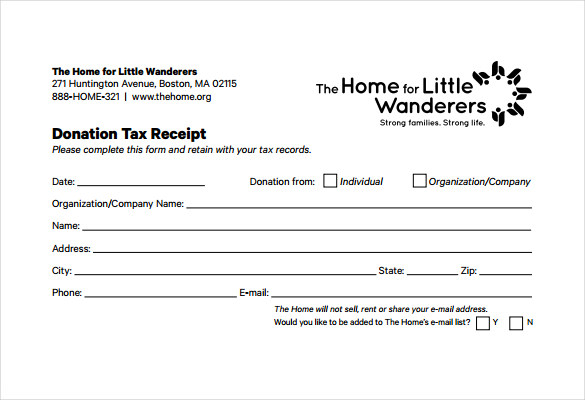

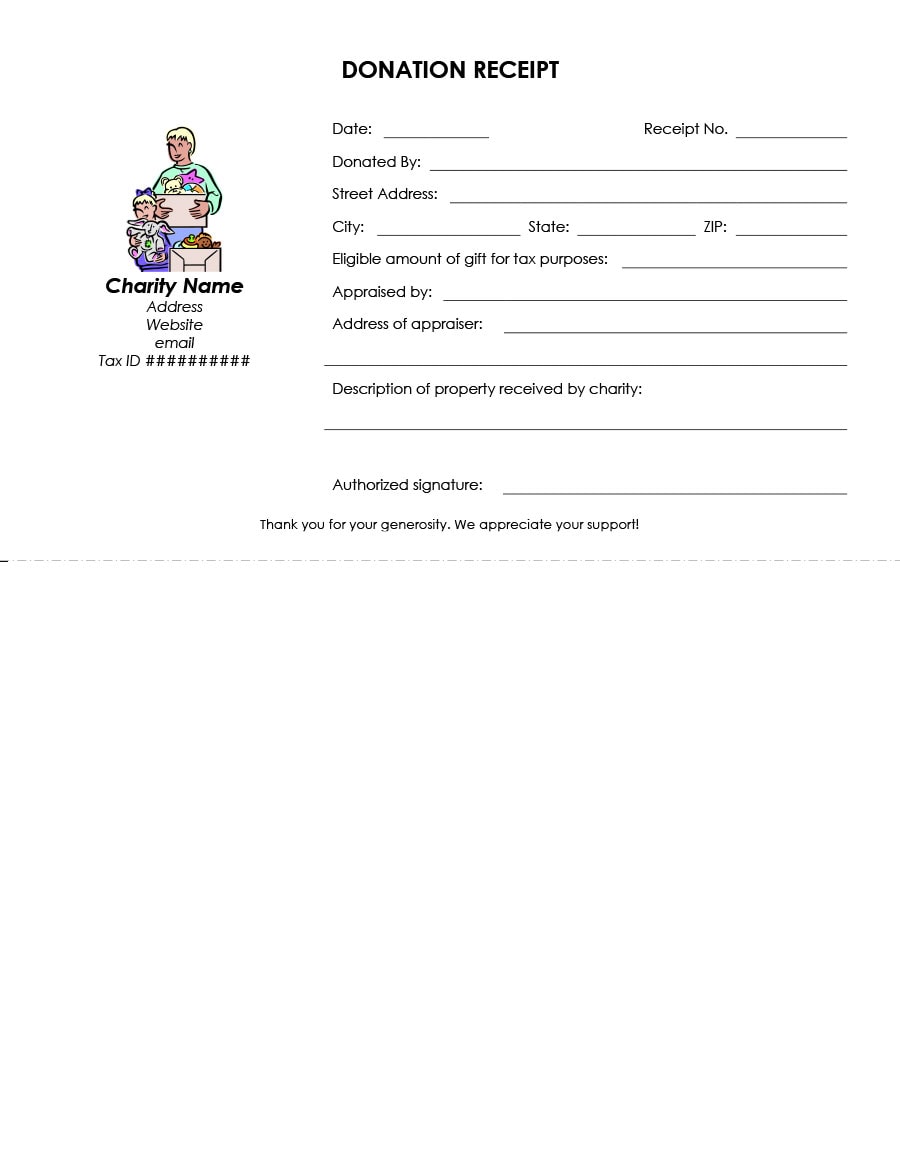

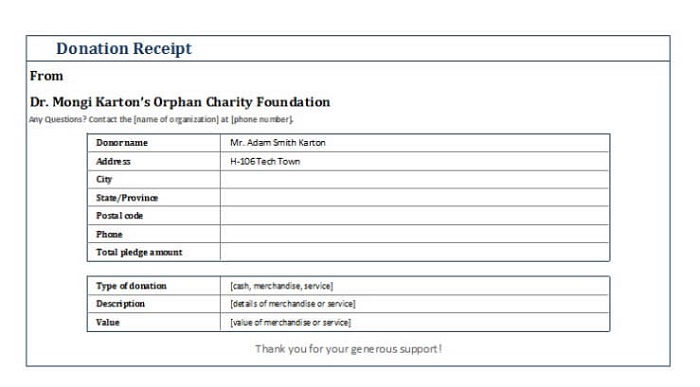

Non Cash Donation Receipt Example. In case your Nonprofit Organisation has received a non-cash donation, then an appropriate receipt should be issued. These will include cash receipt templates, rent receipt templates, sales receipt templates, and hotel receipt templates which will all be printable Donation receipt template are useful for charitable and non-profit making organizations who need to keep a record of the donations they have received.

If you make a non-cash donation such as clothing, furniture, equipment or food to a non-profit, make sure that you get this receipt template for tax purposes.

A donation receipt is proof that a donor made a charitable contribution to a nonprofit.

When Should My Nonprofit Issue Donation Receipts? Transactions in these accounts do not involve payment or receipt Transactions in non-cash expense accounts, such as Depreciation expense, meet the accounting definition of "expense" because they use up assets. When the IRS asks for these documents and the organization is unable to present them, they can be charged with a.