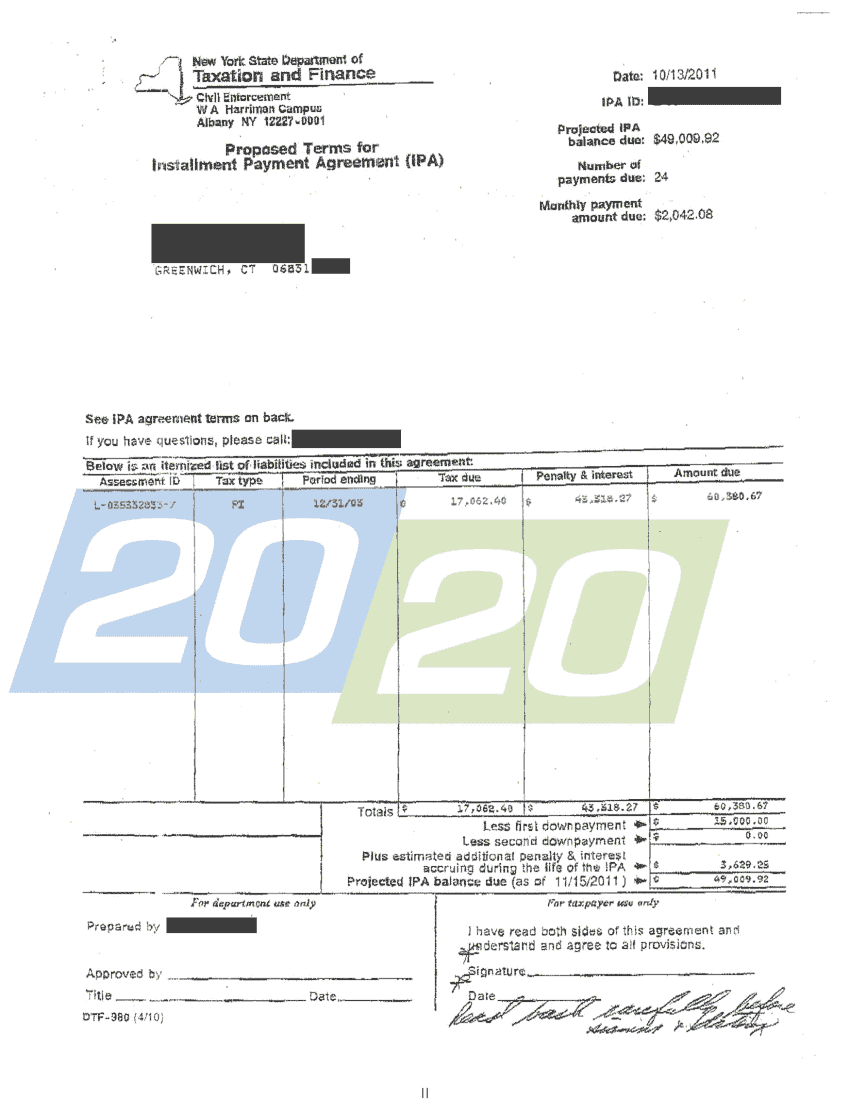

Nys Installment Agreement Form. Installment Payment Agreement Forms are mainly used by companies when they need to discuss with their clients as to how these installments will be paid. Collection of most popular forms in a given sphere.

Download free printable Installment Agreement Form samples in PDF, Word and Excel formats.

Taxpayer Installment Agreement Conditions You agree to: • Make timely monthly payments until your tax liability is paid in full. • An installment agreement requires the buyer of real estate to pay the seller the purchase price in installments over time; the buyer takes immediate possession of the property but the seller retains legal title as security until the buyer pays in full.

If you can't pay your taxes right away but have enough assets and/or income to pay overtime, an IRS An installment agreement is one of the most common payment arrangements for people who owe back taxes to the IRS. If you can pay your debt over time, an Propose a payment plan you can live with. Buyer will insure the goods against all hazards in form and amounts and with an insurer satisfactory to seller.